MenuMenu

- Compare. Save. Ship.

- Main Menu

- How It Works?

- Shipping Services

- eCommerce

- Learn

Struggling with high upfront customs duties and long shipping times to foreign markets? Bonded warehouses, especially in Canada, offer a solution.

“These specialized storage facilities allow you to defer customs payments until your goods are ready for sale or distribution, easing the pressure on your cash flow,” said Greg Woo, Director of Ship Expert.

“Unlike regular warehouses, bonded warehouses keep your inventory closer to international customers while offering flexibility to modify, label, or package goods on-site—all under customs supervision.”

In this blog post, we’ll take a big-picture look at:

Additionally, we’ll discuss regulations and compliance concerns to keep an eye out for and how bonded warehouses are improving the way businesses operate.

A bonded warehouse, also known as a customs bonded warehouse, is a secure facility where imported goods can be stored before duties are paid.

These warehouses, controlled by Canada Border Services Agency (CBSA), allow you to defer duty payments for up to four years while your goods remain stored. This means you can hold inventory without immediate tax or duty obligations.

Bonded warehouses are particularly useful for goods that require special handling, such as alcohol, tobacco, or items needing deep freeze or bulk liquid storage. While in the warehouse, your goods can be manipulated or processed under customs supervision.

If the items are exported or destroyed without entering domestic markets, you may never have to pay duties. On the other hand, if the goods are eventually sold locally, duties are paid at that time.

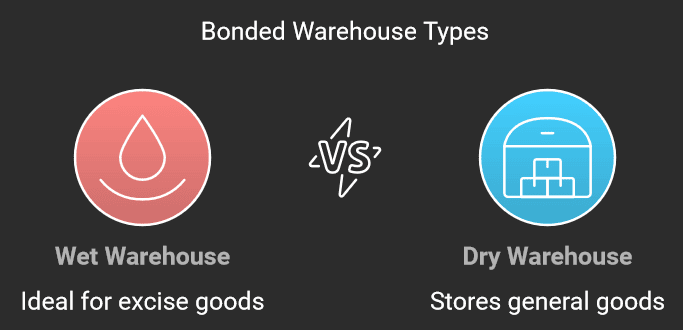

In terms of what bonded warehouses store, there are two primary types: wet and dry.

Wet warehouses are ideal for goods subject to excise duties, like alcohol, tobacco, or fuel. If you’re importing wine, beer, spirits, or similar products, this is the type of warehouse you’ll need. Wet warehouses help manage excise taxes while keeping your inventory secure until it's ready for sale or export.

On the other hand, dry warehouses store general goods that aren't subject to excise duties but still require customs duty. Think of dry warehouses as storage for items like packaged retail goods, raw materials, or clothing. They offer a way to defer customs duties until you're ready to sell or export your products.

In addition, bonded warehouses come in two operational categories:

When using a bonded warehouse, several fees come into play, and it’s important to be aware of them to avoid surprises.

Storage fees vary based on the warehouse, the amount of space your goods require, and how long they’ll be stored. You’ll pay more for larger volumes and longer storage times.

Insurance is another factor, and premiums depend on the value of your goods, the level of security at the warehouse, and your chosen provider. Make sure your coverage matches your inventory's worth.

You'll also need to account for brokerage fees as CBSA requires specific entries for importing, transferring, or exporting goods from the warehouse.

Duties and taxes are paid when you transfer or export your goods. These are deferred until your items leave the warehouse, giving you flexibility on when you settle these costs.

Using a bonded warehouse in Canada means following strict regulations set by the CBSA. These rules ensure that goods stored in bonded warehouses meet all legal and security requirements.

To store goods in one, businesses must comply with eligibility criteria, which includes maintaining detailed records and adhering to specific reporting guidelines. These requirements ensure transparency and accountability for every item stored.

Security measures are also a priority. Bonded warehouses must be secured to prevent unauthorized access, and they remain under CBSA’s supervision until duties are paid or goods are exported. Failing to comply with these regulations can result in hefty penalties and reputational risks.

International trade agreements, such as the Canada-United States-Mexico Agreement (CUSMA), also play a role in governing bonded warehouses.

Under article 20.83 of CUSMA, customs authorities have the power to act on suspected counterfeit trademark goods or pirated copyright goods. These actions can be initiated for goods that are:

These agreements streamline the movement of goods across borders—making it easier for businesses to import and export while reducing trade barriers.

Let’s take a closer look at the ways businesses are improving the way they operate with bonded warehousing.

One of the biggest advantages is the ability to store imported goods for up to five years without paying import duties upfront. This is especially useful for businesses dealing with fluctuating demand, as it allows them to store merchandise until the market improves, avoiding forced sales at low prices.

Bonded warehouses offer a high level of security, ensuring that your goods are safe and compliant with customs regulations. These facilities are tightly monitored, making them ideal for storing restricted items like alcohol, tobacco, or goods that require specific import permits.

With added options like climate-controlled environments and specialized handling for hazardous materials, you can store even the most sensitive goods confidently.

You can also plan ahead for predictable spikes in demand, such as seasonal products or items related to national events. Having your goods already stored and ready for release means faster fulfillment and improved customer satisfaction. This proactive approach helps you meet demand without the delays caused by shipping or customs processing.

Most bonded warehouses are located near major ports of entry, which can save you both time and money. Being close to these logistical hubs reduces the need for additional freight forwarding services and cuts down on transloading costs.

Even lesser-known ports often have bonded warehouses nearby, offering more options for long-term storage and logistics solutions close to your shipping routes.

With Ship Expert, save up to 70% on shipping costs by leveraging bonded warehouses. Store your goods duty-free until you're ready to sell or export, freeing up cash flow and keeping your products closer to international customers for faster delivery.

Whether you're a small business or an e-commerce brand, our pre-negotiated rates and seamless integration with all major carriers give you the competitive edge. Ready to optimize your shipping?

Contact Ship Expert today to start saving.

Director, Ship Expert

Greg Woo is a seasoned expert in the logistics and distribution industry, with a career spanning over two decades. He has a comprehensive understanding of shipping and distribution needs, and has extensive experience integrating with e-commerce stores as well as customer specific WMS (warehouse management systems) and ERP’s (enterprise resource planning software). His tenure in the industry and established courier and LTL partnerships have allowed clients to benefit from reduced shipping expenses, as well as improved operations through software and specialized integrations.

Greg is currently the Director at Ship Expert Inc., a role he has held since February 2015. Prior to his role at Ship Expert, Greg held significant positions at Juxto, a telecommunications and managed internet service provider.